Expedia Group has released its quarterly Traveler Insights Report for Q1 2023. The report highlights the continuing enthusiasm for travel despite economic headwinds and concerns. Expedia Group believes the industry can withstand external factors because of strong pent-up travel demand and household savings.

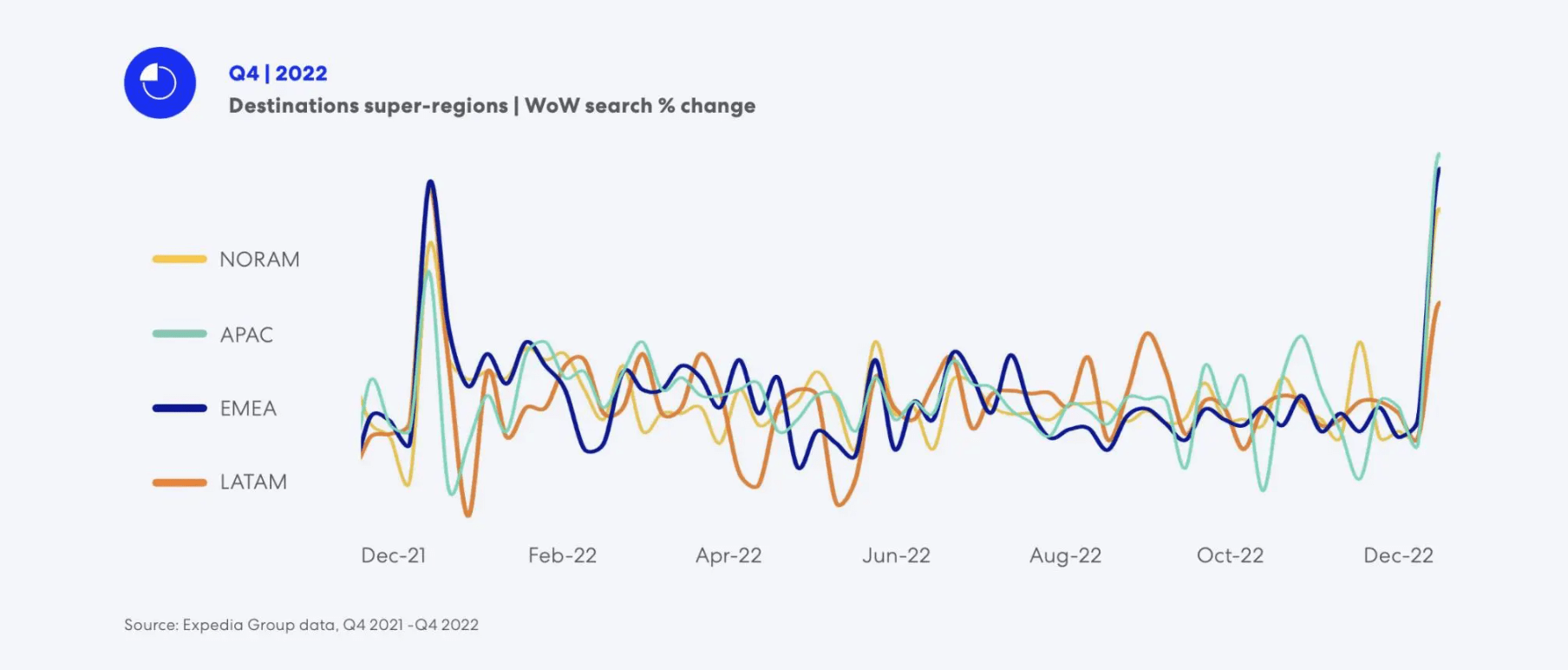

The report reveals that search volumes for travel increased by 10% year-over-year (YoY) globally in the last quarter of 2022. Asia Pacific (APAC) drove much of this growth, as the easing of travel restrictions in China, Hong Kong, Japan, and Taiwan led to increased search volumes. The report indicates that people have become more confident about traveling as they have started planning their trips earlier for 2023.

Global Search Volumes

Overall, traveler intent remains strong, as evidenced by Q4 2022 search volume data. During Q4 2022, 35% of searches were for travel in 2023, representing a 55% YoY increase. Based on first-party data from Expedia Group, the report aims to inform partners and provide insights into shifting traveler intent and demand. The report includes custom research based on hundreds of millions of searches on Expedia Group websites worldwide.

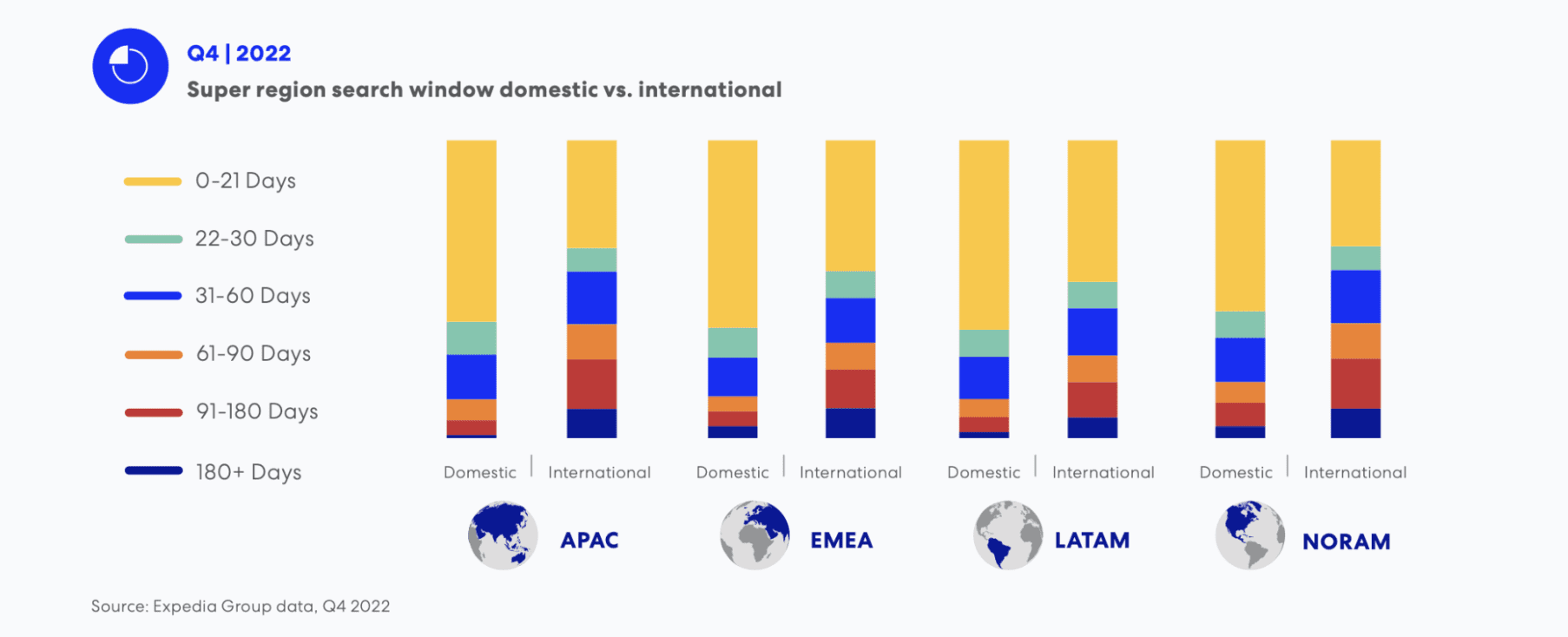

The report shows that the 180+ day search window had the most substantial growth in search share quarter-over-quarter (QoQ), with a 20% increase globally, driven by a 60% QoQ growth in EMEA. The 61- to 90-day search window also saw a nearly 15% QoQ growth globally, with double-digit growth in APAC and NORAM. The 31- to 60-day search window increased by 5% QoQ, led by growth in APAC and NORAM. LATAM travelers are still planning in the short term, with the most growth seen in the 0- to 60-day search windows, up 5% QoQ.

Domestic Search Volumes

Regarding domestic search volume, most global domestic searches fell within the 0- to 30-day window. However, global domestic search for the 180+ day window increased by almost 35% QoQ, driven by growth in both EMEA and NORAM. APAC domestic search share in the 31- to 90-day window increased 10% QoQ, while LATAM markets saw the most growth in search share in the 0- to 21-day and 31- to 60-day search windows. Comparing Q4 2022 to Q4 2019, the domestic search share in the 61- to 90-day window increased nearly 20%, while the 22- to 30-day window saw a 10% increase.

The report also highlights the increase in last-minute holiday searches during December, with searches in the 0- to 21-day window increasing more than 10% month-over-month (MoM). This could be due to weather and airline challenges in NORAM, which impacted thousands of flights during the last two weeks of December and into the new year.

Destination Choice

During Q4 2022, beach and city destinations remained popular due to various factors, such as relaxed travel restrictions in the APAC region, holiday travel, and the allure of warm weather destinations. The global top 10 list of destinations showed only slight alterations from the previous quarter, with New York, Las Vegas, and London continuing to dominate as the leading super regions. Tokyo debuted on the list, Orlando and Cancun rose in the rankings, and Miami surpassed Boston to claim the 10th spot. Similar travel patterns were observed in Q4 2021, as travelers in the Northern Hemisphere sought to escape the cold weather with warm weather getaways.

Conclusion

Expedia Group Traveler Insights Report provides valuable insights into the shifting traveler intent and demand as the travel industry navigates the pandemic. The report shows travelers are becoming more confident about traveling and planning their trips for 2023. The increase in last-minute holiday searches suggests that people are keen to travel despite external challenges. Travel companies and agencies must be aware of these trends and adapt their strategies to meet customer demands.

If your brand is ready to take advantage of the increased interest from travelers in 2023, connect with our travel and tourism marketing experts. We will work with you to create a marketing strategy to get visitors to your destination.